Earlier this week Insurance Edge ran a news story about the amount of insurance fraud which takes place daily across the UK. Although some types of fraud are in decline, there are always new scams and swindles being tried. Can Artificial Intelligence help? Well, David Fulton CEO of WeSee, thinks that we can tackle insurance fraud once and for all with emotion recognition.

One insurance scam is detected every minute in the UK; that’s according to new research published by the Association of British Insurers (ABI). A total of 562,000 insurance frauds were found out by insurers in 2017, of which 113,000 were fraudulent claims and 449,000 dishonest insurance applications.

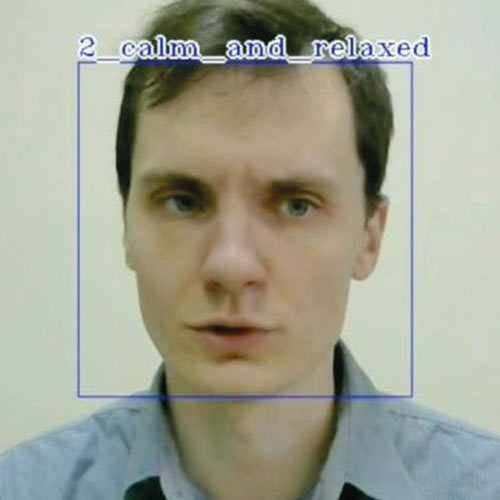

But what if you could simply interview a claimant and instantly be able to assess the probability of them telling the truth? What if you could assess claimants’ facial expressions for suspicious signals, simply by interviewing the claimant using a smartphone camera?

Forget the ‘what ifs’, the truth is that this technology exists today and it could just be the insurance industry’s saviour – facial and emotion recognition technology that understands every multi-layered element within images and videos in the same way humans do. While it’s fair to say that the industry is making strides in detecting and deterring fraud through collaborative work, with the number of fraud crimes down by 8% compared to 2016, the ABI still puts the value of fraudulent claims at £1.3bn (up slightly by 1%).

The answer is quite simple really. Using advanced deep learning techniques, there is a system out there that can analyse an individual’s responses and micro-emotion reactions to a set of questions in real time and deliver an assessment of their veracity to the insurer almost instantly, feeding back visual data and cues to an AI-driven intelligent computer system. What’s more, this would be in the form of a visual dashboard delivering key guidance to the claims handler, enabling them to do their job more effectively by flagging up clearly the most suspicious claimants for further, more detailed investigation.

It has the ability to detect emotions – or more specifically suspicious behaviour – in real time through monitoring and analysing micro-expressions, eye movement, gaze, speech patterns and tone of voice, along with identifying seven key human emotions.

Applied to claimants, it has the power to transform the way insurance companies process claims, assessing their validity more scientifically and accurately than ever before. As the latest ABI figures highlight, the insurance industry needs to reduce the huge burden of fraudulent claims that is currently draining profits. Equipping insurance claims handlers with the tools and technology they need to do their job more effectively by flagging up clearly the most suspicious claimants has the power to benefit the insurance industry, saving time and money for everyone, and combating insurance fraud once and for all.

Original source: https://insurance-edge.net/2018/08/25/opinion-emotion-recognition-could-eliminate-insurance-fraud/